Complete Freedom & Debt Discharge Membership Program Additions

As part of your mission to live completely free of the banker controlled government corporation with their plethora of freedom, money and asset stealing schemes, you'll require other mechanisms to dependably hold and enjoy private conveyances (vehicles), wealth, and property. Additionally, you may require strategies for extricating your kidnapped loved ones from their custody. Unearth the DTSS Freedom Extras that make that possible.

Federal Pure Trust Contract Organizations are used by the well informed, the rich, wealthy, CEOs, politicians, and banking cartel (as well as DTSS) to hold their assets and enterprises, tax free, outside of government statutes, laws, mandates, and jurisdiction.

Federal Pure Trust Contract Organizations are used by the well informed, the rich, wealthy, CEOs, politicians, and banking cartel (as well as DTSS) to hold their assets and enterprises, tax free, outside of government statutes, laws, mandates, and jurisdiction.

They are used to easily pass wealth on to offspring without any paperwork, estate taxes, government intervention, probate, etc.

FPTCOs are irrevocable. This means no one, not even a judge, can legally or lawfully penetrate the trust in any kind of court case. Additionally, since they are written under Common Law, and are contracts, they are nearly impossible to sue to begin with.

Revocable Testamentary, Charitable Remainder, Family, Statutory, Bypass, Grantor, Blind, and Living Trusts are revocable/cancelable by any judge. These trusts are subject to estate taxes, statutes, laws, mandates, probate, and all government jurisdiction.

They provide almost no protection to the estate. They can easily be sued as well. They often end up in probate with attorneys pilfering 90% of the estate. They are as unprotected as a will.

The first step an American National, or even a citizen, should take is to intelligently protect their property.

The best means of accomplishing this is by exchanging or selling assets into properly structured contractual, Irrevocable, Common Law, Pure Trust Organizations.

This lawfully recognized entity provides the ultimate in asset protection, tax immunity, privacy and estate planning. It can also provide tax savings for those required to file returns.

An American National or citizen can still maintain management control of the property, as a Trustee or Managing Director, and all of the benefits of ownership as a Beneficiary or a Capital Unit Certificate Holder, without incurring the inherent liabilities of ownership.

He and/or she can still live in the house, drive the car, operate the enterprise, etc. as long as they do so for the benefit of the trust. However, because the asset(s) belong to the trust organization, and not to the individual, no one, not even the IRS can take the asset(s) due to the purported liabilities of a Trustee(s) or the Beneficiary(ies).

Having property held in an Irrevocable, Common Law, Federal Pure Trust Contract Organization is like utilizing leased property without a drain to finances. Just like leased property, assets which are "held in trust," are unaffected by lawsuits, liens, levies, bankruptcy, divorce, and/or death.

With all assets held by Pure Trust Organizations, there are no assets that the IRS can lawfully lien or levy, making the assets "uncollectible." Contractual Pure Trust Organizations provide the surest road to freedom and financial security permitted by law.

Follow these FPTCO Best Practices to live freely with all of your assets, including yourself and family, completely protected.

Follow these FPTCO Best Practices to live freely with all of your assets, including yourself and family, completely protected.

Most Americans erroneously believe that unless the government sanctions a particular activity, it is illegal. In truth, men and women are free to conduct their personal lives, operate memberships, and hold property outside of the restraints and regulations of the government!

An Irrevocable, Common Law, Federal Pure Trust Contract Organization can lawfully, by contract, hold any type of asset that can be held in the name of an individual, with no statutory restrictions (i.e. houses, rental properties, furniture, cars, jewelry, stocks, bonds, insurance policies, etc.).

An Irrevocable, Common Law, Federal Pure Trust Contract Organization can also conduct operations and own property without a Social Security Number or EIN Number.

The authority for the creation of an Irrevocable, Common Law, Federal Pure Trust Contract Organization is the Common Law right of the parties to enter into a contract. The "right to contract", according to the Constitution for the United States, Article I, § 10, is unimpairable.

That means that it is not within the power of the government, including a judge, to change one word of a Contractual Pure Trust Organization - if it is setup correctly. To do so would violate the Constitution for the United States which is a felony.

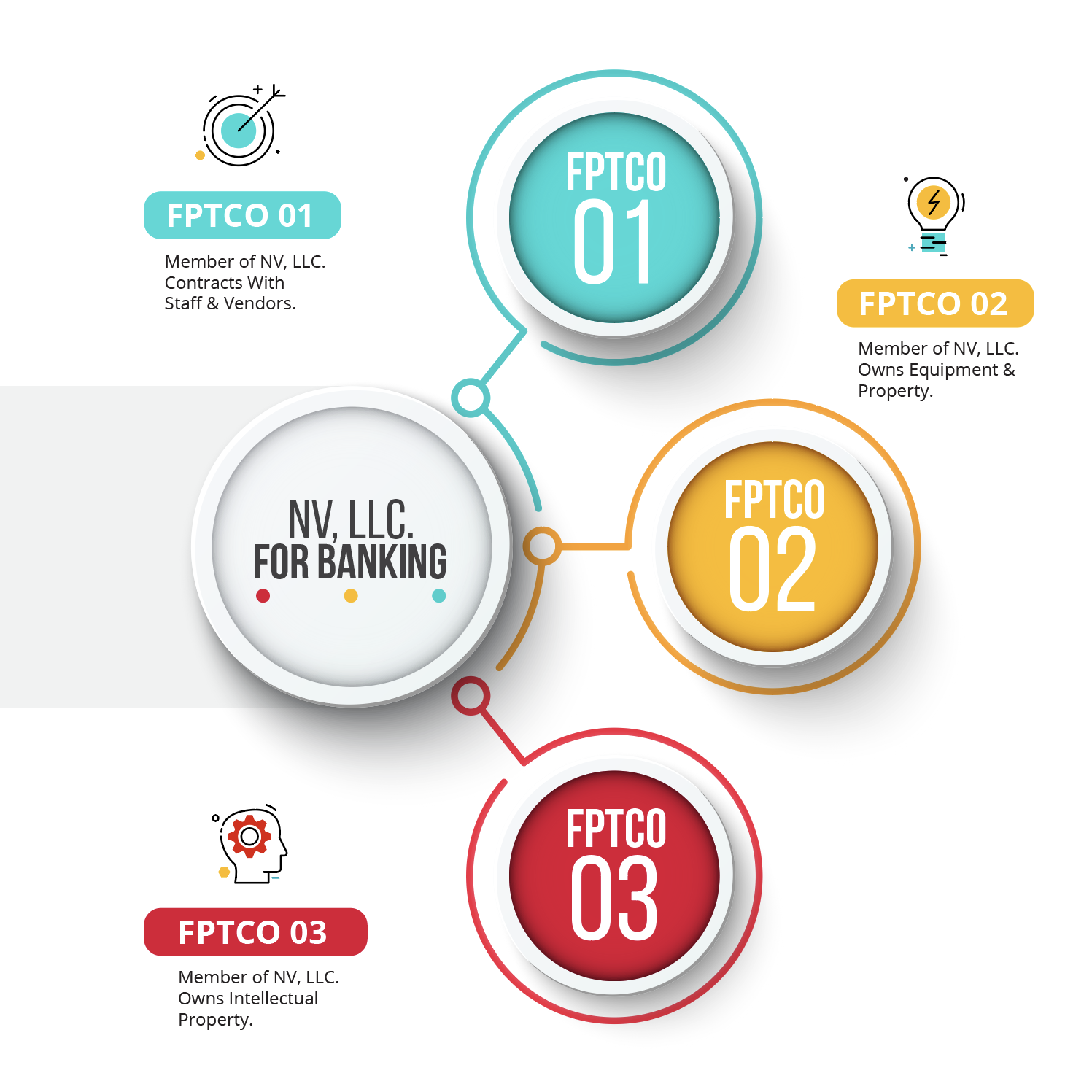

Holding an entity/operation securely can be done using the above structure. Each FPTCO holds the Certificate of Capital Units (CCUs) of the next FPTCO. Each FPTCO is a Member of the Nevada, LLC. Nevada LLCs are passthrough entities with no tax filing requirements.

Holding an entity/operation securely can be done using the above structure. Each FPTCO holds the Certificate of Capital Units (CCUs) of the next FPTCO. Each FPTCO is a Member of the Nevada, LLC. Nevada LLCs are passthrough entities with no tax filing requirements.

Transferring property into a Contractual Pure Trust Organization is as simple as transferring it to any other third party. Property is merely transferred from the name of original owner to the Pure Trust Organization and its Trustee(s).

Once lawfully transferred, the property is subject only to the trust indentures, which create the laws, protecting the property held by it.

There must be an Exchanger (Grantor, Settlor or Trustor) who is exchaning assets into each FPTCO for a portion of their Certificates of Capital Units.

In addition, FPTCO #1 exchanges it's property into that of the FPTCO #2 for a portion of its Certificates of Capital Units. Next, FPTCO #2 exchanges it's property into that of FPTCO #1 for a portion of its Certificates of Capital Units.

"Since the business trust has its origin in the Common Law right of the parties to enter into a contract and does not spring from a franchise granted by the state.

"It has been held that the constitutional authority to levy excises (income tax on the exercise of privileges) upon commodities, a term including corporate franchises, does not empower the legislature to impose an excise (privilege) tax on business trusts."

266 Mass 590, 163 NE 904, 63 ALR 192. 13 Am Jur 2nd 85

Holding wealth securely can be done using the above structure. Each FPTCO holds the Certificate of Capital Units (CCUs) of the next FPTCO. CCUs are exchanged for assets. A CCU holder is considered an Exchanger.

Holding wealth securely can be done using the above structure. Each FPTCO holds the Certificate of Capital Units (CCUs) of the next FPTCO. CCUs are exchanged for assets. A CCU holder is considered an Exchanger.

Revocable Living Trusts, Limited Liability Companies, and Corporations are creatures of statutes, owing their existence to the charter power of the legislature. Such entities may be regulated and taxed by the government because they are exercising the privilege of operating a franchise granted by the state.

The government, therefore, is authorized to impose a privilege excise tax on the entities it creates, in the form of the income tax, which is not applicable to the Pure Trust Organization.

The IRS and state tax agencies have no special powers which allow them to penetrate a properly structured trust organization and to lien or levy property held within it. Unlike a corporation, a Pure Trust Organization maintains the same rights as an American National.

"The fact that a business trust is not regarded as a legal entity distinct from its Trustees, if a true trust...may result in this advantage to the trust, which a corporation does not possess:

"Trusts are entitled to certain rights and immunities such as those guaranteed by the privileges and immunities clauses [Art. IV, §2, CI.1] of the federal Constitution, which do not apply to corporations."

156 ALR (American Law Review) Pg. 51, paragraph 3

As evidenced in a December 1996 letter from Charles F. Felthaus, Chief, Philadelphia Accounting Branch, for the Internal Revenue Service on page 46, "A Pure Trust Organization has no tax requirements." Therefore, a Pure Trust Organization is not legally required to file a tax return.

"All subjects over which the sovereign power of the state extends (i.e. Corporations or other statuary entities) are objects of taxation but those over which it does not extend are upon the soundest principle.

"EXEMPT FROM TAXATION. This proposition may almost be pronounced as self-evident. The sovereignty of a state extends to everything which exists by its own authority or exists by its permission."

McCulloch v. the State of Maryland, 4 Wheat, 316

In Weeks v. Sibley, D.C. 269 F, 155, Edwards v. Commissioner, 415 F2d 578, 582 10th Cir. (1969) and Phillips v. Blatchford, 3 7 Mass 510, the courts ruled that a Pure Trust Organization is not illegal even if formed for the express purpose of reducing or avoiding taxes.

Edison California Stores, Inc. v. McColgan, 30 Cal 2d 472, 183 P2d 16, ruled that persons may adopt any lawful means for the lessening of the burden, of income taxes.

The Department of the Treasury, IRS Handbook for Special Agents §412; Tax Avoidance Distinguished from Evasion states; "Avoidance of taxes is not a criminal offense. Any attempt to reduce, avoid, minimize, or alleviate taxes by legitimate means is permissible..."

Pursuant to Narragansett Mut. F. Ins. Co. v. Burnhamn, 51 RI 371, 154 A 909, it is not an evasion of legal responsibility to take what advantages may accrue from the choice of any particular form of organization permitted by law.

13 Am Jur 2d, 379, Paragraph 51 "One of the objectives of business trusts is to obtain for the trust associates, most of the advantages of corporations, without the authority of any legislative act and with the freedom from the restrictions and regulations generally imposed by law upon corporations."

Irrevocable, Common Law, Federal Pure Trust Contract Organizations may be utilized to hold either personal and/or membership property or to operate an entity/membership. A major advantage to operating a Pure Trust Organization is that it is not a creature of the legislature.

It is not subject to the myriad of strangling legislative controls, and regulations that are applicable to corporations and other legislative entities. The Pure Trust Organization has no compliance costs, such as accountant and attorney fees, that eat up a large percentage of corporate profits.

The Supreme Court case of Eliot v. Freeman, 220 U.S. 178, ruled that "a Pure Trust Organization is not subject to legislative control". The Supreme Court holds that the trust relationship comes under the realm of equity, based upon the common law, and is not subject to legislative restrictions as are corporations and other organizations created by legislative authority.

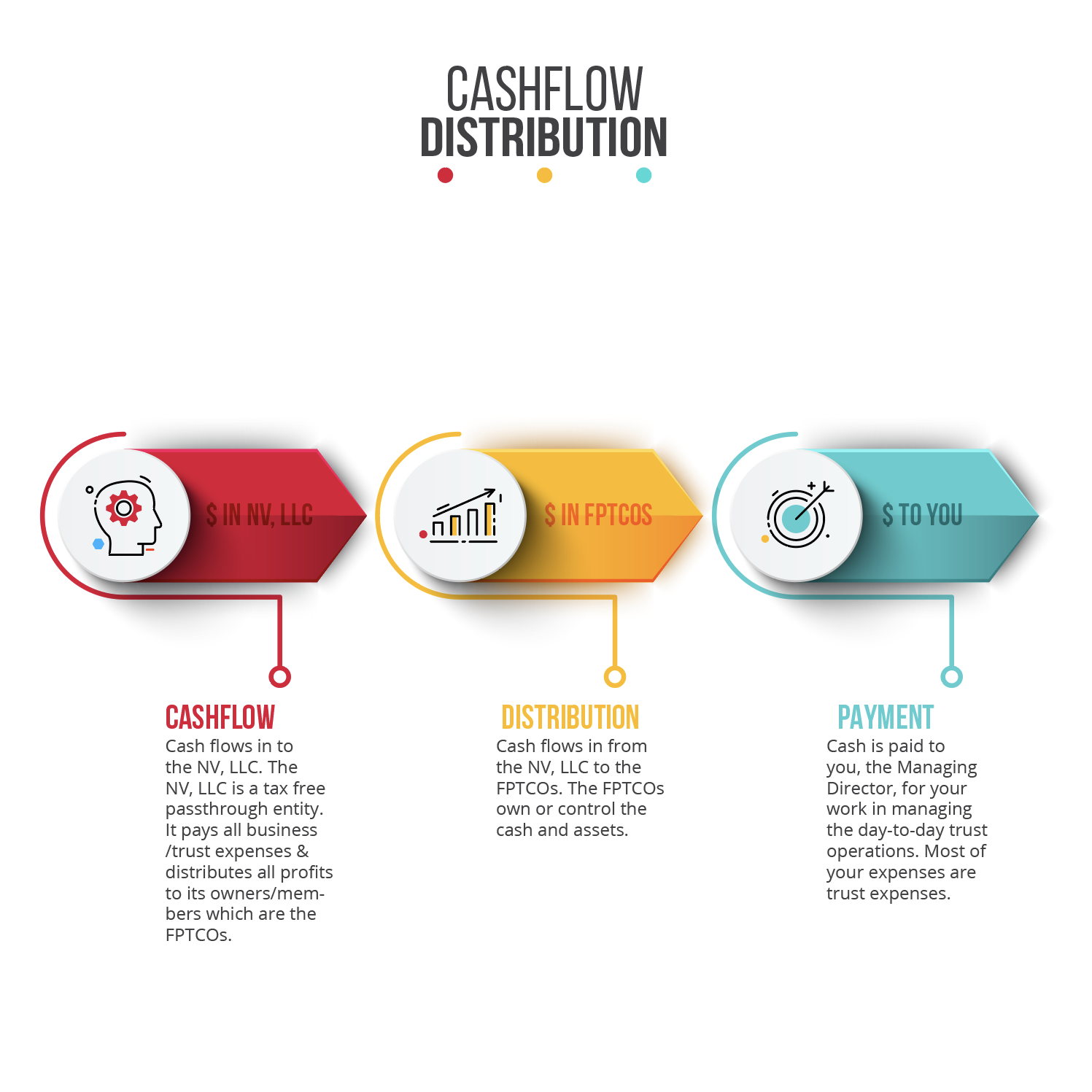

Cash can flow to the FPTCOs tax free using the above diagram. The NV, LLC is a passthrough entity with no tax filing requirements. The FPTCOs are the owners, called Members, of the NV, LLC. The FPTCOs have no tax filing requirements.

Cash can flow to the FPTCOs tax free using the above diagram. The NV, LLC is a passthrough entity with no tax filing requirements. The FPTCOs are the owners, called Members, of the NV, LLC. The FPTCOs have no tax filing requirements.

The FPTCOs then pay you, the Managing Director. If your status has been corrected, then you have no tax filing requirements as well.

The Irrevocable, Common Law, Federal Pure Trust Contract Organization is not liable for the debts of the Trustees or the Beneficiaries and the assets held by the trust cannot be seized to satisfy their debts. Further the Trustees and Beneficiaries are not liable for the debts of the Pure Trust Organization. The beneficial interest in property is not assignable.

"Trust property cannot be held under attachment nor sold upon execution, for the Trustee's personal debts."

Clew v. Jamison, 182 U.S. 461, 21 S. Ct.645

"Trust property cannot be held under an attachment nor sold upon the execution of Trustee's personal debts...Trustees and beneficiaries cannot be held liable for debts incurred by the trust.

"If, in fact, a true trust has been created, the certificate holders are not liable on the obligation incurred by the Trustees or managing agents appointed by the Trustees."

Hussey v. Arnold, 70 NE 87; Mayo v. Moritz, 24 NE 1083

Pursuant to 695.30(a) of the CCP for the State of California and similar Civil Procedure Codes of other states:

"...property of the judgment debtor that is not assignable or transferrable is not subject to the enforcement of a money judgment."

Legislative Committee Comment

"Subdivision (a) of section 695.030 states the general rule is that property is not subject to enforcement unless it is assignable or transferable."

See. e.g. 1 A. Freeman, Law of Executions Sec. I 09 (3d ed. 1900); Murphy v. Allstate Ins. Co., 17 Cal. 3d 937, 553 P.2d 584, 132 Cal. Rptr 424 (1976).

Because the Irrevocable, Common Law, Federal Pure Trust Contract Organization is also not affected by the death of any parties to the trust contract, there is no need for a will, and all probate, death and inheritance taxes are eliminated.

Without proper estate planning, government vultures and attorneys can take the majority of a citizen's estate at his or her death.

FPTCO management involves the Trustees and the Managing Director. The Managing Director (MD) or Co-Managing Directors (CMD) are hired by contract, by the Trustees, to perform the day-to-day operations of the Trust.

The Trust documents will contain an Offering Letter, Acceptance Letter, and Contract for the MD or CMD to agree to. The signatures must be notarized.

Once the Offering, Acceptance, and Contract documents are signed by the MD or CMD, the operational control of the Trust is in their care. The Trustees will have conveyed that responsibility to the MD or CMD by establishing them in a fiduciary relationship with the Trusts.

The MD or CMD does not own any part of the Trust or its assets. The MD or CMD, by their contract, must interact with the Trustees by proposing actions or expenditures in excess of $2,000.00, for consideration.

Meetings of the Trustees are held, Minutes are prepared, and the Trustees either accept or reject the recommendations.

All assets being conveyed to the Trust are by exchange of the item or assets for Certificates of Capital Units. The exchange takes place when the MD or CMD writes a letter, similar to the letter in the creation documents of the Trusts, offering to exchange whatever the assets are, for Certificates of Capitol Units.

Then, the MD or CMD create minutes of the Trustees meeting and records the procedure of the meeting for the acceptance of the offer. The MD or CMD then signs the meeting minutes and conveys both the offering letter and meeting minutes for their consideration and approval.

After approval, the offer letter and meeting minutes are placed in the Schedules portion of the Trust binder thereby becoming a permanent part of the Trust records.

Since the Trust is a separate entity (corpus) and owns itself, it owns the assets exchanged into it and holds them until its dissolution. Then it distributes them to the Certificate of Unit Capital Holders.

At this point, word about Certificates of Capital Units and Certificates of Trust Units is in order. All assets are split title. Certificate of Capital Units convey Legal Title and represent Recorded ownership held by trust.

They reserve the right to receive the value of the assets owned by the Trust when the trust is dissolved. Certificate of Trust Units convey Beneficial Title and the distribution of profits at the Trustees’ discretion. None of the "units" have an established value.

How to Cook a Vulture, by Lynne Meredith

A quick Google search will show you government's attempt at destroying the prominence of Irrevocable, Common Law, Federal Pure Trust Contract Organizations because they work so very well. We know first hand as we have used them, completely unscathed, since 2006.

Just a handful of the countless empowering benefits below

Its contracts, operations, assets, Grantor(s), Trustee(s) Beneficiary(ies) are completely private.

FPTCOs are not subject to any of the millions of government statutes and tax laws. They operate in Common Law.

The Trust Res is transferred immediately at the death of the Managing Director. No need for probate.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to file, report or pay employment taxes.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to file, report or pay many business taxes.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to file, report or pay unemployment.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to file, report or pay any income taxes.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to file, report or pay estate taxes.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to follow or abide by any gov. mandates.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to follow or abide by any gov. statutes.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to have any type of licenses to operate.

FPTCOs are Common Law contracts, not registered entities, and therefore do not have to have any type of permits to operate.

FPTCOs are Common Law contracts, not registered entities, and therefore cannot be named in any lawsuits from outsiders.

FPTCOs are Common Law contracts, not registered entities, and therefore its assets cannot be seized by any outsider or gov agency.

FPTCOs are Common Law contracts, not registered entities, and therefore is not subject to any court judgments or fines.

In order to establish Irrevocable, Common Law, Federal Pure Trust Contract Organizations, it is always suggested that your status is corrected first, via our Complete Freedom Membership Program, so that you yourself are only subject to the Common Law.

It is not required to correct your status to manage a FPTCO. A U.S. citizen can also hold any position of a FPTCO, and most of your trust parties aren't aware of government enslaving them and their need to correct their status anyway.

To order your Federal Pure Trust Contract Organizations, please fill out the form below to be contacted by a Freedom Specialist.

COMMERCIAL LIEN FREEDOM EXTRAS ARE NOT CURRENTLY AVAILABLE

What is a Commercial Lien? If someone has 'wronged' you, by their actions, you have a remedy, in Law. The Common Law is the Law-of-the-Land, and is the highest man-made Law under which the People of the Nation are bound.

What is a Commercial Lien? If someone has 'wronged' you, by their actions, you have a remedy, in Law. The Common Law is the Law-of-the-Land, and is the highest man-made Law under which the People of the Nation are bound.

Under the Common Law, everyone is individually responsible for their own actions. The 'office' they may hold, the 'authority' they may consider they have, and/or the uniform they may wear, does not protect them in any way, shape, form. Simply because they (like everyone else) are responsible for every action they take.

This was set into tablets of stone following Word War II, at the Nuremberg Trials. German Officers claimed "I was only obeying orders", yet they were still found guilty, and hung accordingly. This also forms a part of the Geneva Convention to which most countries are signatories, especially the United Kingdom. Thus "I was only obeying orders" is not a defence.

The reasoning is simple: BEFORE taking any actions against anyone else, make sure that what you are doing is lawful and moral. If you suspect that the action you have been ordered to take is either unlawful or immoral, then you must refuse to obey.

You can report the order, and your reasons for believing it to be unlawful and/or immoral to a higher authority. You can go as high as you like in the chain of authority, pointing out that anyone who conspires to support the unlawful/immoral order are making themselves accomplices, in Law. And that, as a consequence, they (themselves) will be held fully accountable, in Law.

Follow these Commercial Lien Best Practices to execute a judgment in common law against anyone who has severely wronged you.

Follow these Commercial Lien Best Practices to execute a judgment in common law against anyone who has severely wronged you.

In simple terms you write down The Exact Truth of what occurred, based on your first-hand knowledge, including any necessary supporting documentation. You will be writing under penalty of perjury, so do not lie, or make any Statements you feel you cannot prove. You explain the 'wrong', and you claim damages. You claim damages that you feel you deserve.

You write this in the form of a sworn Affidavit, and send it to whoever 'wronged' you, giving them 30 days to rebut what you have said. You tell them that you will remove any Statements they can prove to be incorrect, but the result (after all removals) will be Notarised and placed on to the Public Record.

You must take this step. Because it is honourable, and you must remain in honour. You cannot expect a Commercial Lien to work if you cannot prove this step. Thus your Notice should be sent by Recorded Delivery, such that you can prove it was received.

If you do not take this step you can expect your collar to be felt at some later date because it is essential, and the essence of the Common Law, that a Party you consider offended you has the chance put their side of the story, and you must not deny them that chance.

It is very important to remember how the Common Law works. This is solely by Verdicts of Juries (upon hearing first-hand knowledge-based evidence) and by unrebutted Statements of Truth (also based solely upon first-hand knowledge).

What remains unrebutted, in substance, creates The Truth, in Law. (This is the only way the Law can work. It relies on people being truthful, with the possibility of perjuring themselves if they lie). Note that 'in substance' does not mean 'simple denial' as in "No, I didn't!".

'In substance' means denial with supporting proof. (And remember "I was only obeying orders" is not 'proof', nor is it any kind of defence. Neither, by the way, is "I didn't know" - because ignorance of the Law is no excuse. They should have checked, and discovered whether or not their actions were lawful and/or moral, before doing whatever they did).

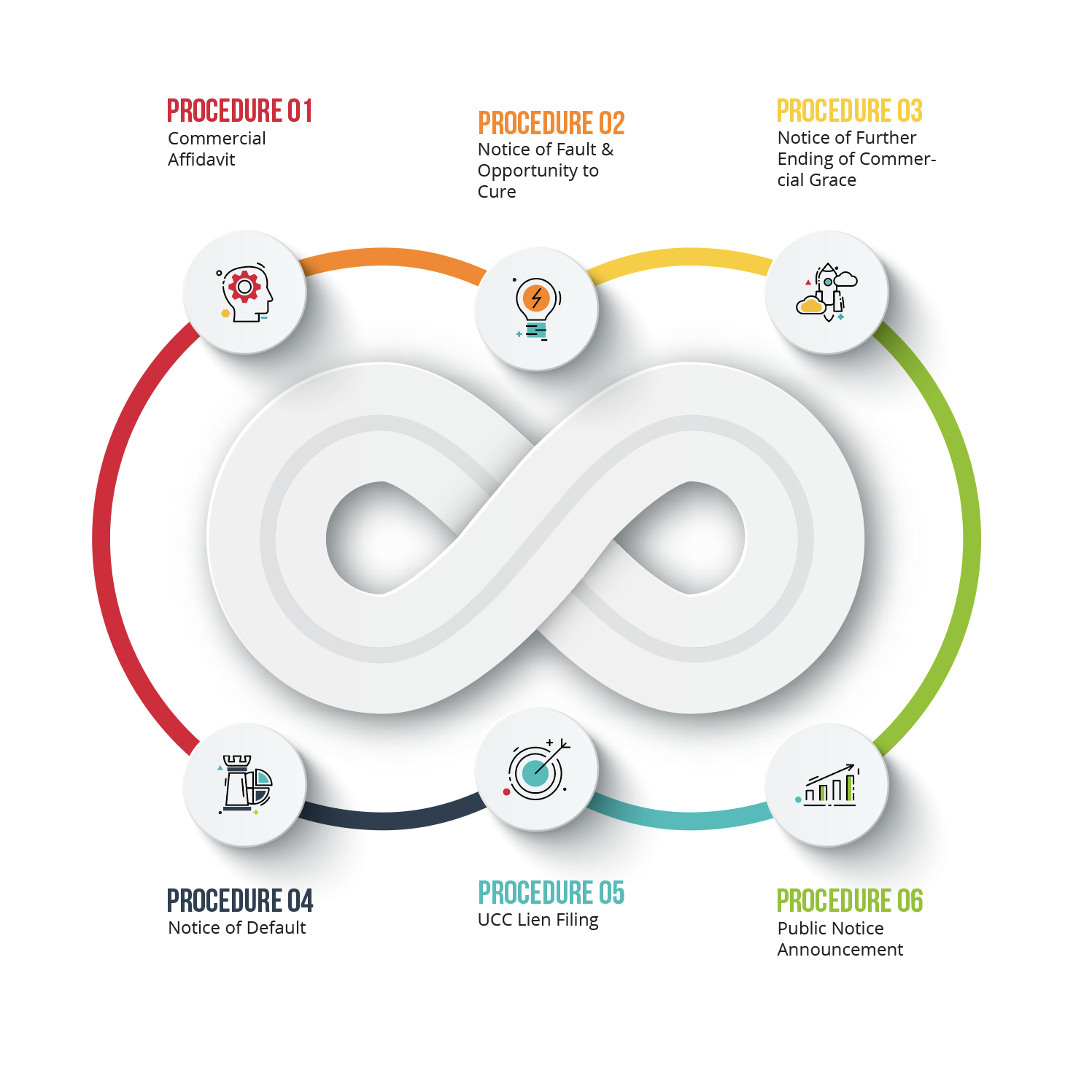

The Commercial Lien process consists of sending these to the accused, giving them time to respond in the correct fashion:

The Commercial Lien process consists of sending these to the accused, giving them time to respond in the correct fashion:

This is why, as a Witness, you are required to swear to: "Tell The Truth, the Whole Truth, and nothing but The Truth". Simply because all judgments are based on that. (I repeat ... it is the only way the Law can work).

Now that you have an Affidavit that remains unrebutted, you can get it notarised by a Notary Public. "Notarising" consists of identifying yourself to the Notary (Using non-citizen passport), and autographing your Affidavit in his or her presence ... such that he or she can verify that it was you, yourself, making your autograph.

All you need to do from this point onward is to "place the fact that your Affidavit exists on to the Public Record". This can be done by talking out a small advertisement in a newspaper. Within the advertisement you can invite Debt Collection Agencies to contact you - in order to actually exercise the Commercial Lien debt.

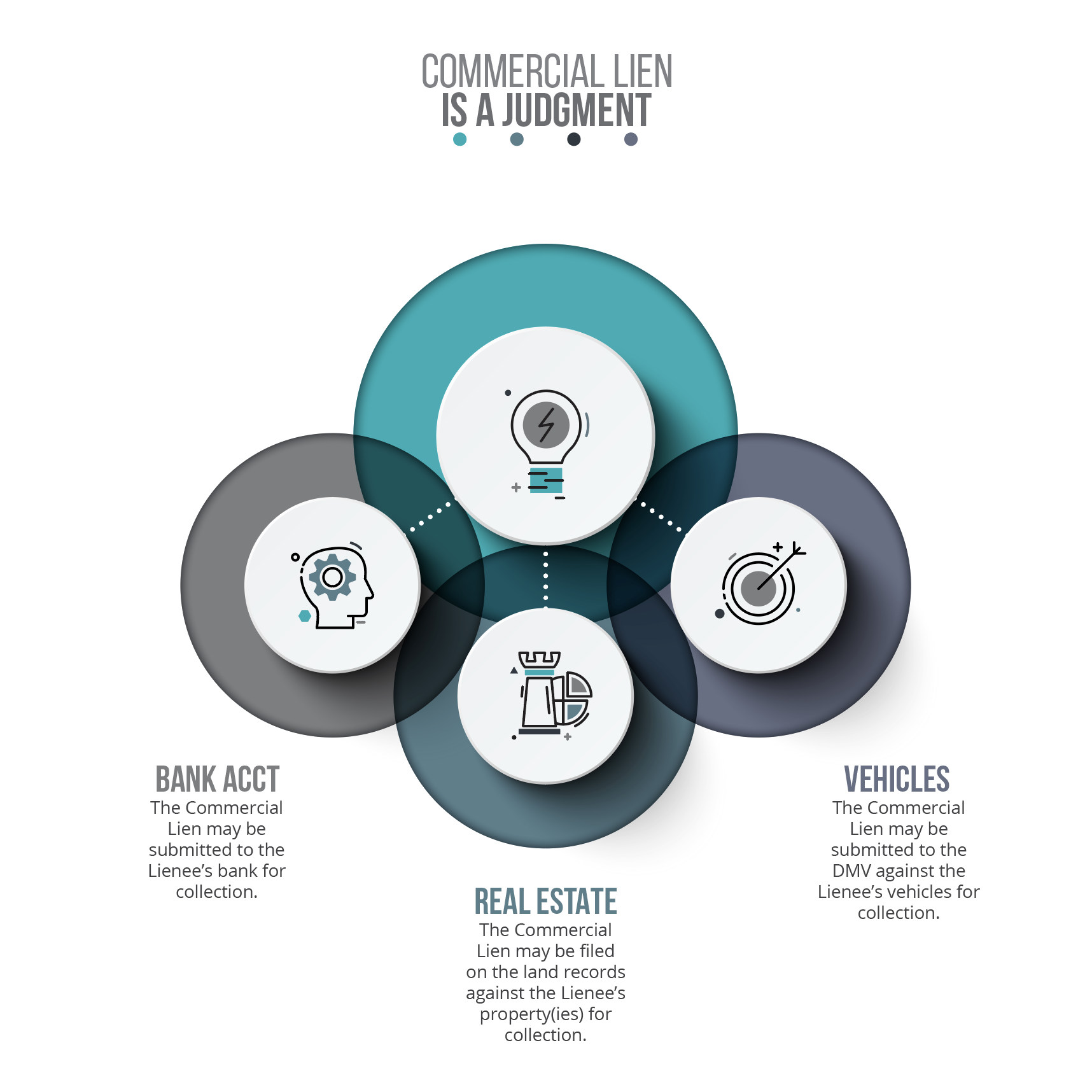

Additionally, you may file the lien against the Lienee's assets as shown here:

Once the Commercial Lien steps have been accomplished and is filed on the public record, a copy may be mailed to the Lienee's known banks with a letter for collection. It may be filed with the county land recording office against the Lienee's property(ies). It may be filed with the Department of Motor Vehicles in the state the Lienee owns vehicles.

Once the Commercial Lien steps have been accomplished and is filed on the public record, a copy may be mailed to the Lienee's known banks with a letter for collection. It may be filed with the county land recording office against the Lienee's property(ies). It may be filed with the Department of Motor Vehicles in the state the Lienee owns vehicles.

Judges know that they cannot affect a Commercial Lien because it is based on first-hand knowledge, which they can never have. Only you can have that knowledge. Only you can make the statements you made. Thus there is nothing for them to "judge", and they know that.

The Lienee, therefore has three options:

The Lienee has only a few options. Pay you, engage in a Common Law Court, or wait 99 years.

The Lienee has only a few options. Pay you, engage in a Common Law Court, or wait 99 years.

Anyone you feel who has wronged you - or conspired to wrong you. For example, the Directors of a Company who have made demands upon you, without a Contract of Obligation from you.

For example, all Debt Collection Agencies who simply write, demanding money, when you have never heard of them before, and know that you have no obligation to "do business" with them. They may write on the basis of a Parking Fine, for example.

The point is they do this without having first obtained a lawful obligation from you. They may very well claim a Warrant from the Northampton Bulk Clearing Centre, but you never consented to be "judged" at Northampton Bulk Clearing Centre (and were never given any opportunity to put your side of the story).

Furthermore the Warrant is not based on the Verdict of a Jury, or sworn Affidavit from first-hand knowledge (computers do not have first-hand knowledge!). So any such Warrant is void in Law. Consequently, if they continually harass you, they are (seriously and criminally!) "wronging" you.

Therefore, you do a little research and uncover the names of Directors. You apply a Lien to each of the Directors, because it it their responsibility to make sure that their Agency acts in honour, and within the Law, not outside of it.

If you read the description above carefully, you will see that - in order to apply a Commercial Lien - you do not need to get a Court's permission. The Lienee would need to take you to Court (with a Jury of 12) in order to get it removed, or the amount reduced, without making a payment.

Obviously you need to be prepared to remove it yourself, if they do pay up.

You may file Commercial Liens against anyone who has severely wronged you. This doesn't mean your associate who owes you a few hundred bucks however. You can file against government agencies, corporations and U.S. citizens. It is not suggested you file against those who are in power, or they could make your life miserable.

You may file Commercial Liens against anyone who has severely wronged you. This doesn't mean your associate who owes you a few hundred bucks however. You can file against government agencies, corporations and U.S. citizens. It is not suggested you file against those who are in power, or they could make your life miserable.

In order to obtain a Non-Judicial Commercial Lien, your status must be corrected via our Complete Freedom Membership Program, so that you yourself are only subject to the Common Law.

To order your Non-Judicial Commercial Lien, or if you're not a Complete Freedom Member and wish to become one, please fill out the form below to be contacted by a Freedom Specialist to enroll.

When cars, trucks, motorcycles, boats, etc. ("Vehicles" for this discussion) are manufactured, the manufacturers send what is called a Manufacturer's Statement of Origin to the dealer.

When cars, trucks, motorcycles, boats, etc. ("Vehicles" for this discussion) are manufactured, the manufacturers send what is called a Manufacturer's Statement of Origin to the dealer.

Manufacturer’s Statement of Origin is the Legal Title to the vehicle.

Dealers send the Manufacturer's Statement of Origin (MSO) to the Department of Motor Vehicles whenever a vehicle is bought by a U.S. citizen whom resides in that state, and intends to register the vehicle in said state. Remember that dealers finance the registration fees and profit from doing so as well.

If a free American National informs the dealer the vehicle will be exported, or will not be registered in said state, the dealer will give the MSO to the free American National for them to register in the country the vehicle is being exported to.

Where would a free American National export the vehicle to? Keep in mind that MI, MICHIGAN, State of Michigan, are franchise corporations of the U.S. Government corporation. So said man or woman would be exporting their new private conveyance to Michigan Republic.

Follow these De-Registration Best Practices to deregister your vehicles and travel freely in your "private household goods."

Follow these De-Registration Best Practices to deregister your vehicles and travel freely in your "private household goods."

Since the U.S. Government Chapter 11 Bankruptcy of June 5, 1933, all states being franchises of the U.S. Government were also bankrupted. They declared under the Emergency Relief Act of 1933 that "the ownership of all property is in the state."

Vehicle titles are similar to the state's role in creating the Legal Title to the CQV Trust, the Certificate of Live Birth, which the U.S. Government then became the Trustees of, and the citizen became the chattel property of leaving them with only Equittable Title to their own bodies.

“Certificate of title” means a paper document issued by any jurisdiction specifically as evidence of vehicle ownership. A certificate of title is not necessarily the only evidence of vehicle ownership issued by a jurisdiction."

Notice the “For Official Government Use Only” sticker on the back of your new registration stickers from the state. Notice the words “VOID” in the watermark of your “Certificate of Title” in several places.

The sate is the Trustee of the registered vehicle, which makes them the Legal Title holder in that trust relationship. Only an owner can license, force registration, abidance of their laws regarding acting in commerce on the road, and insurance on behalf of the Equittable Title Holder.

The DTSS De-Registration and Lawful Traveler Plates Freedom Extra includes accomplishing the steps to obtain Legal Title to the vehicle for you, as well as the Private Traveler package as shown below:

For more information on traveling in your de-registered private conveyance, please review the articles, script and documents on the Difference in Driving v. Traveling Freedom Education Module (provided to Members only), inside the Member Area.

This diagram shows how the State becomes the Legal Title owner of all vehicles. 1) Car dealerships register vehicles in the name of the CQV Trust by sending the Manufacturers Statement of Origin, Legal Title, to the State. 2) The State becomes the Legal Title holder, and is already the Trustee of the State created CQV Trust and its assets. 3) The citizen becomes the Equitable Title holder, and Lessor, of the vehicle they thought was theirs.

This diagram shows how the State becomes the Legal Title owner of all vehicles. 1) Car dealerships register vehicles in the name of the CQV Trust by sending the Manufacturers Statement of Origin, Legal Title, to the State. 2) The State becomes the Legal Title holder, and is already the Trustee of the State created CQV Trust and its assets. 3) The citizen becomes the Equitable Title holder, and Lessor, of the vehicle they thought was theirs.

In order to obtain De-Registration and Lawful Traveler Plates, your status must be corrected via our Complete Freedom Membership Program, so that you yourself are only subject to the Common Law.

Next, your "vehicle" must be paid off, or discharged via our Debt Discharge Membership Program.

To order your De-Registration and Lawful Traveler Plates, or if you're not a Complete Freedom Member and wish to become one, please fill out the form below to be contacted by a Freedom Specialist to enroll.

U.S. citizen, in American law, one who, under the constitution and laws of the United States, has a right to vote for civil officers, and himself is qualified to fill elective offices. One of the sovereign people.

U.S. citizen, in American law, one who, under the constitution and laws of the United States, has a right to vote for civil officers, and himself is qualified to fill elective offices. One of the sovereign people.

A constituent member of the sovereignty, synonymous with the people. 19 How. 404. All persons born or naturalized in the United States, and subject to the jurisdiction thereof, citizens of the United States and of the state within they reside. Amend. XIV. Const. U.S. Black's Law Dictionary First Edition, 1891.

"A citizen of the United States is a citizen of the Federal Government..." Kitchens v. Steele, 112 F.Supp 383 (1953) State v. Manuel, 20 NC 122 (1838): "the term 'citizen' in the United States, is analogous to the term 'subject' in Common Law; the change of phrase has resulted from the change in government." Supreme Court: Jones v. Temmer, 89 F. Supp 1226 (1993)

"The privileges and immunities clause of the 14th Amendment protects very few rights because it neither incorporates the Bill of Rights, nor protects all rights of individual citizens. Instead this provision protects only those rights peculiar to being a citizen of the Federal Government."

It does not protect those rights which relate to state citizenship. "The only absolute and unqualified right of a United States citizen is to residence within the territorial boundaries of the United States." Supreme Court: US vs. Valentine 288 F. Supp. 957 (D.C.P.R., (1968).

Only those who've corrected their status to that of a free American national, Republic state citizen are free.

Only those who've corrected their status to that of a free American national, Republic state citizen are free.

THE U.S. SUPREME COURT:

a. "Inasmuch as every government is an artificial person, an abstraction, and a creature of the mind only, a government can interface only with other artificial persons. The imaginary, having neither actuality nor substance, is foreclosed from creating and attaining parity with the tangible.

The legal manifestation of this is that no government, as well as any law, agency, aspect, court, etc. can concern itself with anything other than corporate, artificial persons and the contracts between them." S.C.R. 1795, Penhallow v. Doane’s Administrators 3 U.S. 54; 1 L.Ed. 57; 3 Dall. 54 (1795); and,

b. "the contracts between them" involve U.S. citizens, which are deemed as Corporate Entities:

c. "Therefore, the U.S. citizens residing in one of the states of the union, are classified as property and franchises of the Federal Government as an "individual entity", Wheeling Steel Corp. v. Fox, 298 U.S. 193, 80 L.Ed. 1143, 56 S.Ct. 773 (1936)

When the employees representing a government violate this principal and fail to correct themselves when made aware of their violation, they are willfully committing an ultra vires act in violation of the Corporate Charter of which their employer was instituted under.

“Mr. Justice Marshall said: The doctrine of ultra vires is a most powerful weapon to keep private corporations within their legitimate spheres and to punish them for violations of their corporate charters, and it probably is not invoked too often... Zinc Carbonate Co. v. First National Bank, 103 Wis 125, 79 NW 229 (1899)”American Express Co. v. Citizens State Bank, 194 NW 430. (1923).

A U.S. citizen owns NO property as slaves cannot own property. Anyone that carefully reads their deed to a property will conclude they are listed as a TENANT. (Senate Document 43, 73rd Congress 1st Session (1933)) and a slave can own nothing, NOT even what are thought to be their children.

(Tillman vs. Roberts 108 So. 62, Van Koten vs. Van Koten 154 N.E. 146 (1926), Senate Document 438 73rd Congress 1st Session (1933), Wynehammer v. People 13 N.Y. REP 378, 481 (1856)). This is the reward for being a U.S. citizen.

A citizen of the United States is a citizen of the Federal Government..." Kitchens v. Steele, 112 F.Supp 383 (1953) State v. Manuel, 20 NC 122 (1838): "the term 'citizen' in the United States, is analogous to the term `subject' in Common Law; the change of phrase has resulted from the change in government." Supreme Court: Jones v. Temmer, 89 F. Supp 1226 (1993)

"The privileges and immunities clause of the 14th Amendment protects very few rights because it neither incorporates the Bill of Rights, nor protects all rights of individual citizens. Instead this provision protects only those rights peculiar to being a citizen of the Federal Government.

"It does not protect those rights which relate to state citizenship." "The only absolute and unqualified right of a United States citizen is to residence within the territorial boundaries of the United States. "Supreme Court: US vs. Valentine 288 F. Supp. 957 (D.C.P.R., (1968).

The use of "State citizen" above refers to the State corporate franchises of the U.S. government corporation. It is not signifying a Republic State citizen. A Republic State citizen is one who has corrected their status to that of a free American national via a DTSS Complete Freedom Membership.

The use of "State citizen" above refers to the State corporate franchises of the U.S. government corporation. It is not signifying a Republic State citizen. A Republic State citizen is one who has corrected their status to that of a free American national via a DTSS Complete Freedom Membership.

At birth, the IMF accepts ownership of the chattel citizen as payment for the U.S. Government's bankruptcy debts to the Federal Reserve System (now owned by the IMF). The IMF deducts approximately $1,000,000.00 from the U.S. Government's balance, per citizen.

The U.S. Government does this by converting the Birth Certificate into a bond, which is then paid to the IMF. The IMF then sells these bonds (T-Bills) on the markets. They open an account at the Federal Reserve Branch which received said payment bond from the U.S. Government. The social security number is the account number.

The Birth Certificate, slave bonds increase in value continually, and the asset covering those ever increasing valuations is the living being's slave labor extracted via taxes, tickets, fines, fees, and you guessed it, incarceration, which allows the jails cheap slave labor.

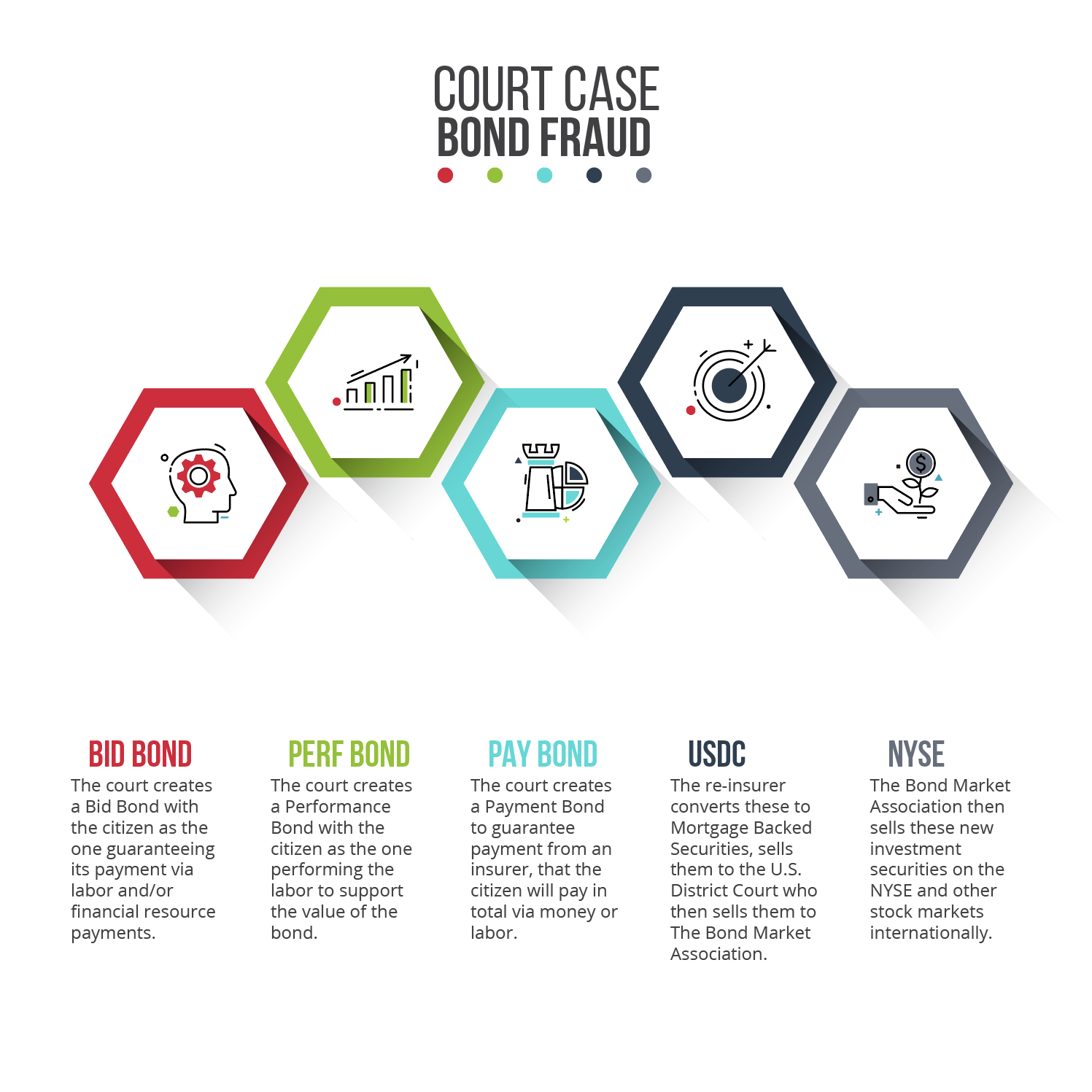

In all court cases, the case itself becomes a sellable bond. The courts issue a Bid Bond, a Performance Bond, and a Payment Bond that is sold against the private Federal Reserve Account, held under the citizen's all capital letter name entity.

The judge, and his accomplices sell these bonds and do not report the income!!!

[https://www.law.cornell.edu/uscode/text/1/8]

Using proprietary remedies of modifying the contract court case, and using certain bonds, then reporting the court clerk, and officers involved to other agencies for things like tax evasion, kidnapping, human trafficking or attacking their bonds, etc. we are able to have the cases thrown out of courts and have those incercerated released. Along with having these perpetrators investigated by other government agencies.

The diagram above outlines the bond fraud committed by all courts, the U.S. District Courts, and the re-insurers of the bonds. Knowing this gives us options to have said cases and bonds dismissed or discharged.

The diagram above outlines the bond fraud committed by all courts, the U.S. District Courts, and the re-insurers of the bonds. Knowing this gives us options to have said cases and bonds dismissed or discharged.

In order to obtain Victimless Crime Incarceration Release, it is suggested (not required) that your status is corrected via our Complete Freedom Membership Program, so that you yourself are only subject to the Common Law.

To order your Victimless Crime Incarceration Release, or if you're not a Complete Freedom Member and wish to become one, please fill out the form below to be contacted by a Freedom Specialist to enroll.