Freedom & Success Education Membership Program

DTSS's Extraordinarily Phenomenal Membership Programs Will Save You. The DTSS Complete Freedom Membership Program

is the only solution to bring you 100% out of all government jurisdiction, allowing you to operate in their system

from arms length, and teaches you everything you will need to know to protect your property, natural rights & life.

The U.S. Government/ICE can now detain, arrest, and deport U.S. citizens to prisons in El Salvador and elsewhere. Drone footage has shown executions at those prisons. Police/ICE are now immune from all discipline for any actions they take while on duty. So they can get away with beating even killing U.S. citizens without any recourse.

The U.S. Government/ICE can now detain, arrest, and deport U.S. citizens to prisons in El Salvador and elsewhere. Drone footage has shown executions at those prisons. Police/ICE are now immune from all discipline for any actions they take while on duty. So they can get away with beating even killing U.S. citizens without any recourse.

The banking cartel is hyper-inflating the dollar. Trump's high tarrifs will cause the price of everything to skyrocket, as Americans take out more debt to stay afloat prices will skyrocket even further. When the masses begin to starve, the banks will offer Universal Basic Income, Digital Currency, Biometric ID. That's it, game over.

The banking cartel is hyper-inflating the dollar. Trump's high tarrifs will cause the price of everything to skyrocket, as Americans take out more debt to stay afloat prices will skyrocket even further. When the masses begin to starve, the banks will offer Universal Basic Income, Digital Currency, Biometric ID. That's it, game over.

Trump has indirectly declared Martial Law. 1) Police can now do as they wish and are immune from all accountability while on duty. 2) No U.S. citizen or state agent can obstruct government from doing anything. 3) Citizens can no longer refuse consent to search their home, car or body. 4) Military used for crime prevention nationwide.

Trump has indirectly declared Martial Law. 1) Police can now do as they wish and are immune from all accountability while on duty. 2) No U.S. citizen or state agent can obstruct government from doing anything. 3) Citizens can no longer refuse consent to search their home, car or body. 4) Military used for crime prevention nationwide.

Real ID links every gov. dataset, debts, fingerprints, retinal scan, and facial ID. Have an unpaid ticket? Missed last month's toxic vaccine? Trying to buy meat? Freeze, military will arrive in three minutes. You'll be force injected, money taken immediately, no food or travel until you comply. Religious exemptions are voided.

Real ID links every gov. dataset, debts, fingerprints, retinal scan, and facial ID. Have an unpaid ticket? Missed last month's toxic vaccine? Trying to buy meat? Freeze, military will arrive in three minutes. You'll be force injected, money taken immediately, no food or travel until you comply. Religious exemptions are voided.

To create a private economy, we plan to give our own crypto currency to our Members who have corrected their status with us.

Time is running short. Call us now to enroll at (800) 490-4495, Ext: 1.

Here you'll learn our authoritative debt relief strategies. Please review this summary of DTSS's robust Member benefits and unparalleled methods; as well as by what medium government took all U.S. citizens as chattel collateral, payment for their third bankruptcy debt (March 6, 1933-June 5, 1933) to the international banking cartel. Below that you'll unearth the steps that make Debt Discharge possible, comparisons of debt relief programs like debt consolidation and debt settlemnt, and some of the numerous benefits of our program.

In DTSS's Complete Freedom Membership Programs: your freedom is restored, you are no longer subject to ANY of the endless U.S. Government victimless crime laws, income taxes, judgments, licenses, permits, incarceration, etc. You regain total ownership of your body and can do whatever you please. Plus so much more!

In DTSS's Debt Discharge Membership Programs: you're out of credit card, tax, court, and student loan debts (vehicle and secured loan debts if you qualify) quickly, easily, and successfully once and for all, with a lower monthly payment, a better debt-to-income ratio, and a new credit profile. Plus so much more!

Plus in all of our programs you'll receive 36 Modules of Freedom and Success Education revealing the real secrets of living freely and how to be, do or have anything your heart desires.

DTSS has built the most advanced Complete Freedom, Debt Discharge Membership Programs in the world. All Via a State-of-the-Art User Interface, Customized, Automated Document Creation, Automated Email Notifications & Step by Step Instructions. NOW With Extremely Robust, Powerful & Instant 24/7/365 Member Care Via Artificial Intelligence, Help Center, Email, Live Chat & SMS Channels.

We are extremely grateful for our Never Ending Quality Improvement via extensive research and development by countless experts, which have led us to develop lawful administrative remedies designed to anticipate and overcome the de facto Federal Government's, state's, county's, alleged creditor's, and debt collector's subterfuge, and other unscrupulous maneuvers.

All of the above, built on a state-of-the-art infrastructure, and robust software systems that provide our Members what are deemed to be the best methods for completely freeing themselves, and discharging alleged debts. We unceasingly work to improve the quality of our programs.

As part of their sturdy foundation, our programs rely upon comprehending legalese, as well as portions of the laws, acts, codes, and statutes below which are explained as needed in your program:

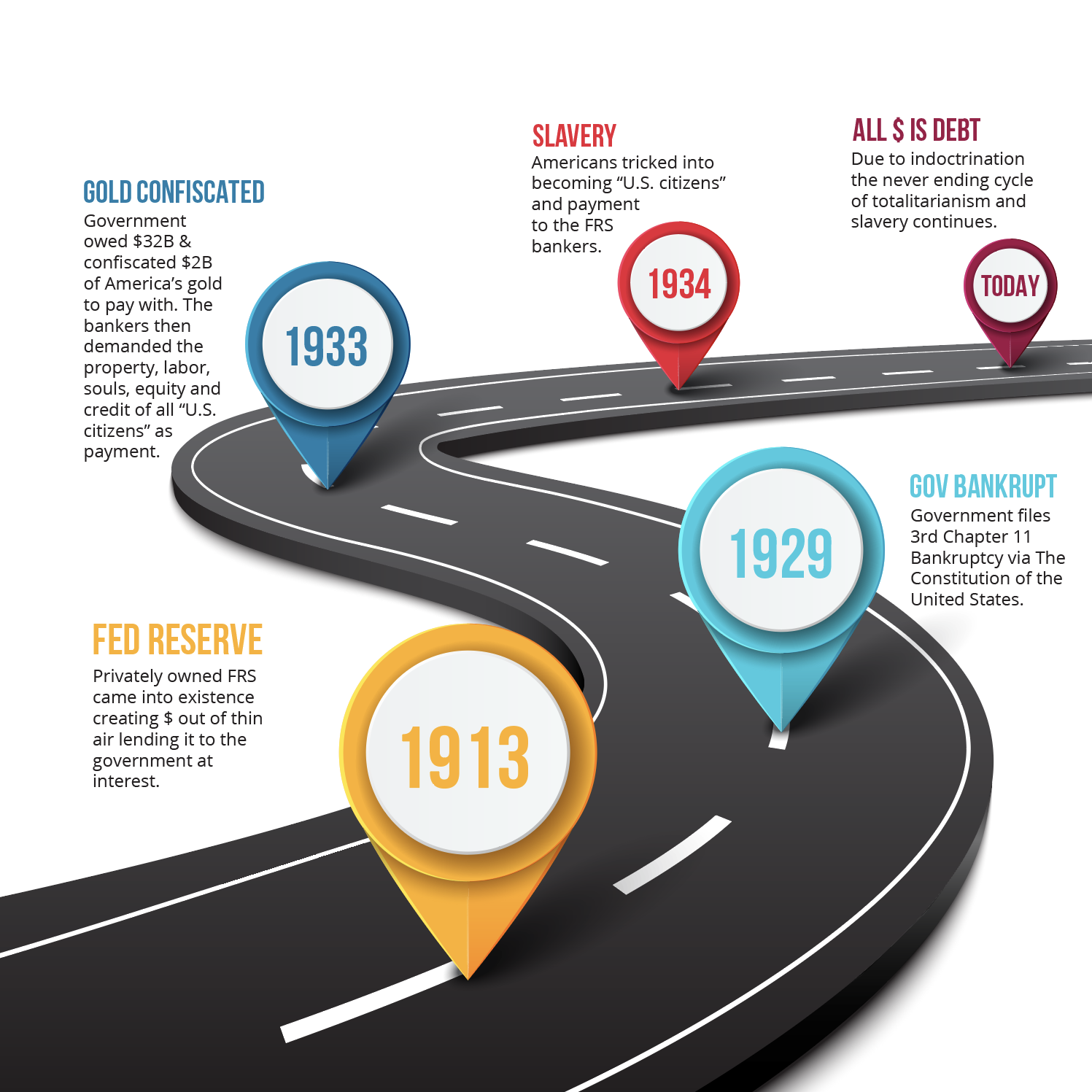

After the War for Independence, the new National Confederate Government could not pay off the debts it had incurred during the revolution, including paying soldiers who had fought in the war and American Nationals who had provided supplies for the cause.

The new government, although having the ability to coin money, having no required gold and silver to back it, was bankrupt and had a huge debt to repay the French bankers.

The government, previously having no real revenues or subjects to collect from had to contract with the states for a proportional repayment plan...the Constitution "for" the united States of America. The Constitutions (there have been four thus far) are bankruptcy compacts between the states and government, and in international law creditors have 70 years to collect from their bankrupt debtors.

In the original bankruptcy and Constitution of 1791, all states agreed to their portion of the debt repayment. On February 25, 1863 the U.S. Government filed its second bankruptcy, during the Rothschild instigated and funded Civil War.

On February 21, 1871, the U.S. Government was reestablished by the banking cartel, into a District of Columbia corporation, Communist Democracy, and no longer a free Republic. At that time all states became corporate franchises, and subsidiaries of the U.S. Government corporation.

Thanks to the banking cartel's strangle hold over the 50 states, the U.S. Government, Inc. is continually led into massive debt via interest payments on previous debt, massive ever increasing size, wasteful spending on things such as NASA and war, and because constitutions are international bankruptcies that are only collectable for 70 years, the U.S. Government corporation must refile its Bankruptcy Chapter 11, every 70 years.

As detailed in our banking history, these bankruptcies have occurred 1789-1793, 1859-1863, 1929-1933 and 1999-2003.

Since the signing of the first Constitution, the U.S. Government had paid its debt payments to its creditors with lawful money exchangeable for gold, then once again in 1933 became insolvent and could no longer retire its debt, namely to the Federal Reserve System, et. al.

President Franklin D. Roosevelt effectively dissolved the de facto United States Government by declaring the entity bankrupt and insolvent under Chapter 11 Bankruptcy. All of the assets of the U.S. Government corporation became property of the international bankers once again.

The bankruptcy started in 1929. Roosevelt came into office and immediately declared a "Banking Holiday."

Under the Emergency Banking Act, March 9, 1933, 48 Stat. 1, Public law 89-719, expressed in Roosevelt's Executive Orders 6073, 6102, 6111, and 6260 "Trading With The Enemy Act," House Joint Resolution 192 (since repealed), Public Law 73-10, of June 5, 1933, 31 USC § 5118, confirmed in Perry v. U.S., 1935, 294 US 330-381, 79 L.Ed. 912, as well as 31 USC § 5112, 5119, Senate Report 93-549, and 12 USC § 95a, which made all obligations, public or private, no longer collectable in gold.

Roosevelt, whom survived numerous assassination attempts, had to confiscate all of America's privately held gold, which only totaled a small percentage of the bankruptcy debt owed.

The parasitical international bankers then claimed all future property, labor, souls, children, sweat equity and credit of every "U.S. citizen" already registered or to be registered, as payment towards this debt. The only "U.S. citizens" at that time were the freed negro slaves and their offspring.

The bankers would then trick the free American nationals into becoming citizens of the privately owned U.S. Government corporation.

All of our gold was confiscated two months prior, to be turned in to the local FRS branch by May 1, 1933 and therefore no real money existed from that point on. This eliminated our ability to pay our debts.

Instead, all debts public or private were to be "discharged" upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts.

Fed-created and lent into circulation "Federal Reserve Notes" ("promissory notes" which are promisses to pay real money if any ever exists again) became that legal tender.

As of October 27, 1977 a Federal U.S. Court of Appeals ruled on Title 31 USC § 5118 that legal tender for discharge of debt is no longer required.

Since 1913 "Scrip" money or [negotiable debt instruments] were issued by a private corporation known to everybody as: "The Federal Reserve System."

These promissory notes were called Federal Reserve Notes and our future treatment by the U.S. Government was to be redefined in 1933 under 50 USC, the 1917 Trading With The Enemy Act 5(b), in which U.S. citizens are now defined as, "an enemy of their government" and this is why a Declaration of War is renewed yearly by Congress and the President!

...prove that in 1933, the United States Government, formed under the executive privilege of the original Martial Rule (when the Southern States walked out of Congress on March 27, 1861, and quorum to conduct business was lost), went bankrupt, and a new state of national emergency was declared under which United States citizens were named as the enemy to the government and the banking system as per the provisions of the Trading With The Enemy Act of 1917.

All free American Nationals residing within the Republic of States suddenly and falsely were expatriated (via their Birth Certificates as explained below) from their free, living status without their knowledge or consent; and their labor, souls, children, property, sweat equity and credit became the financial collateral for the public debt, which had then been converted into a Public trust, which had been scripted after the ancient Roman trusts.

That's Right, Americans Became Serfs - Chattel Property and Enemies of the International Banking Cartel and the U.S. Corporate Government!

When a child is born, the mother delivers the newborn to an agent/licensed doctor of the state, in a federally funded hospital. She fills out the application for a Certificate of Live Birth (while under pain and medication) which creates a title to a public, fictitious entity with a similar sounding "name" as what the baby is to be called, or is to be "known as."

The difference is that private, free men and women do not have "names," especially "last names." You have your parental given First and Middle, from the Family of... These are not called "names." You are "known as." All "names" are copyrighted by the Rothschild corporation called "The Crown.”

The hospital then creates the Certificate of Live Birth, with what your father's family is "known as," and it's called the "Last Name" on the COLB. The hospital immediately files at the county registrar...

Notice of an unclaimed vessel at our delivery ward in Chicago. [If it's yours come pick it up!] The population merely think those are "birth" announcements of children being born, and therefore never take action to reclaim ownership of the Title to their own newborn babies.

Within five days of registering the Certificate of Live Birth at the county registrar, the hospital is then obliged to send the original Certificate of Live Birth (Title of Deed to Real Property) to be registered with the Bureau of Vital Statistics or in some states the Department of Health and Rehabilitative Services, in the state of the birth. The state then creates the original "Birth Certificate."

After 30 days, the county registrar issues the parents a "copy" of the warehouse receipt, the Certificate of Live Birth, which now equates to an abandonment of title for the unclaimed cargo, a vessel, and ward of the state solidified by the registration.

Next, the state sends this new Birth Certificate, as payment for its share of constituted bankruptcy debt owed to the U.S. Government, (a District of Columbia corporation), to be registered at the U.S. Department of Commerce, Bureau of Census "Executive Office," whom uses the fictitious First Middle Last name (aka: ALL CAPITAL LETTER NAME, Legal Name or Strawman) abandoned vessel title, which creates a decedent estate and Cestui Que Vie Trust (CQV Trust), pronounced "ses–tee–kay."

Government obtains ownership by becoming trustee of the new CQV Trust. The government sees it as we'll keep it unless or until someone else claims it. "It" meaning Legal Title (Birth Certificate) to the Title of Deed to Real Property (Certificate of Live Birth) and CQV Trust assets, which the baby will later become the "res," substance, asset, chattel property, surety, and guarantor of.

The Department of Commerce notifies the Department of Treasury of its newly registered asset. The Department of Treasury then issues an interest bearing bond on the Birth Certificate, which is title of the Cestui Que Vie Trust.

The amount of the bond valuation (in 2012, the year of this research), was usually $630,000.00 - $1,260,000.00 at birth, is derived from International Monetary Fund actuarian tables based on things like race, birth state and other ridiculous items.

The Department of Commerce and Department of Treasury are also franchises of the Federal Reserve System, originally a Puerto Rican Canon Law trust formed in 1913 as a "Joint Stock Trust."

Its shareholders were other banks, whose shares were owned by trusts for a handful of international bankers. Now the Federal Reserve and all government agencies are owned by the IMF, which is owned by trusts controlled by the same international banking cartel.

The bonds are then listed with the Securities and Exchange Commission and always sold to the Federal Reserve System/IMF, at face value.

The Federal Reserve System, or rather the IMF, then uses the Cestui Que Vie Trust entity as collateral to issue more Federal Reserve Notes when you, the soon to be U.S. citizen, take out some other form of debt obligation, meaning allegedly borrow. See 12 USC § 411.

This bond is then held in trust for the Federal Reserve/IMF owners by the Depository Trust Corporation, under it's subsidiary Warehouse Trust Co., LLC, located at 55 Water Street, Suite 3, New York, NY 10041. Interestingly, the name on the building is "Tower of Power."

In summary again, once the application for a Certificate of Live Birth is registered, it becomes the unclaimed Title of Deed to Real Property. Since it's unclaimed, the state claims it and then creates the Birth Certificate as the "Legal Title" to it.

Then the state sends the Birth Certificate to the Federal Government. Finally the Federal Government creates a bond on the Birth Certificate which is their payment slave bond to the Federal Reserve/IMF for the government's bankruptcy debt.

These actions are an unwritten, unexpressed Cestui Que Vie Trust. The state is the Executor, the Federal Government is the Trustee, and the Federal Reserve/IMF is the Beneficiary. The state is a constitutor, responsible for paying the debt of the U.S. Government to the Federal Reserve/IMF.

Throughout your life, the actions you've taken as will be outlined in the next section, have left you the man or woman, with only "Equitable Title" to your own body. Exactly the same as when you registered your car with the state, the state takes Legal Title and the car becomes property of the state.

The state then gives you Equitable Title to your car. Equitable Title means you can use it, and do not own it. Hence the reason they require you to insure their vehicle, can charge you fees, fines, and tickets for misusing their vehicle, or not following their rules of "commerce" on the roads.

If you wish to challenge this premise, don't pay the next five parking tickets, you could cancel your car insurance, how about travel in it without your driver license, don't pay the annual registration, drive 140MPH on the way to Vegas, etc., and watch how fast the owner of the vehicle comes to confiscate it with armed men.

It is this Cestui Que Vie Trust entity which owes all of your alleged, mathematically impossible to repay debts to government and banks. It is this entity which is subject to the tens of millions of victimless crime laws. It is this entity that is required to have permits and licenses, etc., etc.

You unknowingly became surety/guarantor for the government owned and controlled CQV Trust entity via contracts, such as applying for a Social Security number, registering to vote, using the domestic address, and more with the U.S. Government corporation.

Applying for a Social Security number with the U.S. Government is where you admitted, under penalty of perjury, that you are a U.S. citizen (rather than a free American National, Non-Resident Alien or American de jure State Citizen) and are the responsible party for the CQV Trust entity, and are therefore applying for a social(ist) security tracking number. Ooops!

Only fictitious entities acting in commerce, federal employees or officials on Federal land (Washington DC, Guam, Puerto Rico, etc.) are required to have Tax ID numbers in the de facto U.S. Government's jurisdiction.

Your answering to, giving the name, birth date, address, and behaving as if you were the Legal Name or all Capital Letter Name, JANE MARY DOE/JOHN HENRY DOE entity, which is the name of the CQV Trust, also strengthens the government's presumption that you are it and responsible for it.

Sending and receiving mail using the government territorial state abbreviations and zip codes also cemented you to their territorial jurisdiction.

You then further solidified you are in fact the CQV Trust entity by applying for a driver license, using the CQV Trust's all capital letter name. Free men and women may travel anywhere without licenses. Only slaves or those acting in commerce on the roads are required to obtain licenses.

You then crystallized the fact you are the CQV Trust entity and responsible for it even further by signing any government form, applying for any type of license or permit, paying any tickets, or government fees of any kind.

Then for the real whopper, you signed under penalty of perjury that you are that entity, living on "federal land" and are a "federal employee" when you filed your first and every single income tax. Checkmate!

In proper English all fictitious entities are written in capital letters.

Definitions:

Gage Canadian Dictionary, 1983, Sec. 4 defines Capitalize adj. as: To take advantage of – To use to ones own advantage.

Blacks Law Dictionary, Revised Fourth Edition, 1968, provides a more comprehensive definition as follows:

Capitis Diminutio. (meaning the diminishing of status through the use of capitalization) – In Roman law. A diminishing or abridgment of personality; a loss or curtailment of a man’s status or aggregate of legal attributes and qualifications.

Capitis Diminutio Maxima. (meaning a maximum loss of status through the use of capitalization, e.g. JOHN DOE or DOE JOHN) – The highest or most comprehensive loss of status. This occurred when a man’s condition was changed from one of freedom to one of bondage, when he became a slave. It swept away with it all rights of citizenship and all family rights.

Capitis Diminutio Media. (meaning a medium loss of status through the use of capitalization, e.g. John DOE) – A lessor or medium loss of status. This occurred where a man loses his rights of citizenship, but without losing his liberty. It carried away also the family rights.

Capitis Diminutio Minima. (meaning a minimum loss of status through the use of capitalization, e.g. John Doe) - The lowest or least comprehensive degree of loss of status. This occurred where a man’s family relations alone were changed. It happened upon the arrogation [pride] of a person who had been his own master, (sui juris) [of his own right, not under any legal disability] or upon the emancipation of one who had been under the patria potestas. [Parental authority] It left the rights of liberty and citizenship unaltered. See Inst. 1, 16, pr.; 1, 2, 3; Dig. 4, 5, 11; Mackeld. Rom.Law, 144.

Capite. Lat. By the head Diminutio. – Lat. In civil law.

Diminution. a taking away; loss or depravation.

DTSS's Extraordinarily Powerful Membership Programs Are Unrivaled

The reorganized Legal Name Trust will operate in commerce with bank account, and have a lien held by you against its assets, thereby thwarting judgment creditors.

The Legal Name Trust gets its own Tax ID number, allowing it to build a new credit profile. Managed intelligently, this will ensure access to credit in the future as required.

In DTSS Debt Discharge Programs you'll be out of debt in a fraction of the time it would take you on your own, even if you were never late, over the limit, or ever charged again.

What Members Say About the High-Caliber Debt to Success System Membership Programs

Debt Relief Membership Program, where you're out of credit card, tax, court, and student loan debts (vehicle and secured loan debts if you qualify) quickly, easily, and successfully once and for all, giving you a lower monthly payment, a better debt-to-income ratio, and a new credit profile for the estate. Plus so much more!

An impressive handful of DTSS debt discharge statements for proof of our work. Your debt relief is only a phone call away. Call us now at (800) 490-4495 to speak with a Freedom Specialist.

Ignorance of the law is no excuse is the plausible deniability excuse used by the U.S. Government corporation and its owners (The Crown & Vatican).

For more than 90 years, they've purposely had curriculums remove all of the pertinent grammar details, as well as their fraudulent banking history.

This has made it easy to deceive the masses into ignorantly and voluntarily becoming their chattel slaves via "signing" their many documents.

I.e.: The Driver License Application, Passport Application, Voter Registration, Social Security Application, Form 1040, Traffic Tickets, Permits, Etc.

However, there is always a remedy in law, which they also carefully hid from you. DTSS has uncovered, and thoroughly brings you that remedy.

You were born a free boy or girl. Then you unknowingly "signed" (only fictitious entities have signatures, living wo/men have autographs) under penalty of perjury that you are a U.S. citizen (you weren't, you were an American national, I.e.: a Massachusettsian).

You were born a free boy or girl. Then you unknowingly "signed" (only fictitious entities have signatures, living wo/men have autographs) under penalty of perjury that you are a U.S. citizen (you weren't, you were an American national, I.e.: a Massachusettsian).

You signed that you are a "resident" living "in" the fictitious U.S. corporation because you used a zip code and state abbreviation. You signed that you are the registered, fictitious entity created by the Certificate of Live Birth filing that was claimed by the state, then paid to the U.S. government corporation for its bankruptcy debt to the Federal Reserve System/IMF.

You'll acquire and duly authenticate the Certificate of Live Birth, which regains you Legal Title of Deed to your physical body, the Legal Name/Birth Certificate entity the state created, and the CQV Trust entity that the U.S. gov. held the unclaimed title of, which you repeatedly claimed you were.

Once you've acquired the Certificate of Live Birth, the Title of Deed to Real Property, you will execute an Affidavit of Ownership of the COLB Title of Deed to Reap Property as evidence that you are now the holder in due course of this Title of Deed to Real Property. This will be used in future filings.

Once you reclaim this title to your body, you'll restructure the CQV Trust and become Trustee. A new tax ID number is acquired. This restructured trust entity is controlled by you, and is what you'll use to participate in commerce with. It pays taxes on its business profits, which should be none.

Next, you'll begin the registration of a 50 state nationwide DBA, sole proprietorship in the all capital letter name as a separate entity than your living, breathing self; which gets forwarded to all State Attorney Generals. It may be used during debt discharge, traffic tickets, court cases, and more.

Change of address stops the banks and gov. from selling bonds in every variation of the name, against the SS# acct. I.e.:, every time you applied for a credit card, they sell bonds in different variations of the name such as: Doe, John Henry, John Doe, John H. Doe, JOHN HENRY DOE, JOHN H. DOE, etc.

You'll then file a lien, held by you the living man or woman, against this reorganized trust entity. The lien will cover every single asset it could ever own, and everything already owned in the Legal Name. This makes all of its assets untouchable by government, alleged creditors, and/or anyone else.

Additionally, you'll publish on the public record your common law trade-name, trademark, copyright notice, prohibiting all of government, police, banks, etcetera from using any variation of what you are known as well as the reorganized trust's name. Violators agree to pay $500,000 for said violations.

Here, you'll open the reorganized CQV trust entity's bank account in order for it to act in commerce as an outside entity that you control as Trustee. This allows you to control its funds and its credit at arms length. You'll also be able to and should stop using accounts tied to the social secuirty number.

After the above you may submit a new W-4 form at the employer for that of the reorganized CQV Trust with its Tax ID number. This will allow the trust to claim exempt from all of the income tax withholdings required to be paid by the legal named entity with its social security number. Certain restrictions apply.

Following this, asd Trustee you'll apply for a new credit card on behalf of the reorganized CQV Trust with its Tax ID number you now control. This begins a new second credit profile, which you'll be able to leverage and use for and on behalf of the reorganized CQV Trust, as long as you remain a Trustee of it.

Then, you'll appoint both Secretaries of the Treasury as fiduciary, financially responsible for the reorganized CQV Trust's finances. This includes termination of any previous fiduciary relationship between you and the artificial Legal Named CQV Trust entity, as well as you holding any public office.

Besides the above, you'll notify the Internal Revenue Service and Secretary of Treasury that the reorganized trust is NOT a "resident" or "citizen" of the U.S. corporation, and therefore is not a "taxpayer." Instead it is a foreign entity of the United States corp. that will act in their commerce system.

Alongside the previous steps, using a registered bond, you'll have the Treasury open the Contract Trust Account. Contract Trust Accounts are used for gov. investments and disbursements. The appointed Treasury fiduciaries will be given direct access to this account, making it simple to discharge any debts.

You'll deliver a Durable Powers of Attorney for Securities & Savings Bond Transactions to the Secretary of Treasury, whom is the reorganized CQV Trust fiduciary. This gives them the ability to access the previously funded CTA to perform any and all transactions that may be required to discharge debts.

Shortly thereafter, you'll notify and revoke trusteeship from the appropriate U.S. Government franchises for their gross incompetence. You'll prove you, the living wo/man, are the Trustee of the reorganized CQV Trust, have a lien against it, along with proof that you own the title of the Legal Name entity.

Furthermore, you'll acquire the non-U.S. citizen, Republic State Citizen passport and Identification card, issued by the Department of State, proving you are a free State National. Among other things, in discharging debt, this is partly used as evidence of your private secured party creditor status.

In this debt relief program you become a "private banker," able to discharge all of the estate's (the Legal Name) debts in the same "specie of money" it was created and allegedly lent to the estate. This is done by creating negotiable instruments to tender payment in full.

In addition to proving you are the living breathing wo/man, not the Legal Name estate, but control it, and are therefore a private banker, the Department of Treasury discharges the alleged debt from the previously funded Contract Trust Account.

In DTSS's Debt Discharge Membership Programs: you're out of credit card, tax, court, and student loan debts (vehicle and secured loan debts if you qualify) quickly, easily, and successfully once and for all, with a lower monthly payment, a better debt-to-income ratio, and a new credit profile. Plus so much more!

You will also receive access to 36 Modules with over 180 hours of video teaching you real secrets to living freely and becoming successful so you can be, do or have whatever you dream.

Leading Debt Management Programs Don't Compare

In the DTSS Debt Discharge Membership Program you're out of debt in 18 months ending with a far better debt-to-income ratio, and a brand new credit profile! Plus you'll be enlightned with powerful proven secrets to freedom and success.

In the DTSS Debt Discharge Membership Program you're out of debt in 18 months ending with a far better debt-to-income ratio, and a brand new credit profile! Plus you'll be enlightned with powerful proven secrets to freedom and success.

Just a handful of the countless empowering benefits below

Many of the foundational steps of the DTSS Debt Discharge Membership Program only need to be done once, allowing you the ability to discharge more debt, much faster, in the future.

You will become a Private Banker able to discharge your secured debts dollar for dollar via the correct financial instrument(s) in conjunction with U.S. Government House Joint Resolutions, numerous U.S. and international laws.

You will become a Private Banker able to discharge your student loan(s) dollar for dollar via the correct financial instrument(s) in conjunction with U.S. Government House Joint Resolutions, numerous U.S. and international laws.

You will become a Private Banker able to discharge your credit card(s) dollar for dollar via the correct financial instrument(s) in conjunction with U.S. Government House Joint Resolutions, numerous U.S. and international laws.

You will become a Private Banker able to discharge your unsecured debt(s) dollar for dollar via the correct financial instrument(s) in conjunction with U.S. Government House Joint Resolutions, numerous U.S. and international laws.

You will become a Private Banker able to discharge your income tax debt(s) dollar for dollar via the correct financial instrument(s) in conjunction with U.S. Government House Joint Resolutions, numerous U.S. and international laws.

Your monthly payments will be much less than your current expenditures, for a fraction of what you "owe," and you'll be out of debt multiple times faster than you possibly could on your own.

You will become Trustee of the Legal Name Trust, with its own tax ID number, which you'll open a bank account with, giving the trust borrowing ability with its new Credit Profile.

You will have much less of your income going out towards debts, which automatically gives you a substantially better debt-to-income ratio, making you more credit worthy.

You and the Trust you control will be safe from judgments by way of holding a large first in line lien against the trust and its assets, in case there is ever a threat of a law suit.